Selected

Case Studies

Secondary Transactions with European and North American healthcare investors

Our experienced investment team has a long history of completing secondary transactions with European and North American healthcare investors to acquire equity positions in portfolio companies

Schroder UK Public Private Trust plc

Secondary transaction to acquire seven equity positions in healthcare companies

GrowthWorks Canadian Fund

Secondary transaction to acquire fifteen equity positions in healthcare companies

Top 10 Pharma Corporate Venture Capital

Secondary transaction to acquire over 10 equity positions in healthcare companies

Karolinska Development

Secondary transaction to acquire thirteen equity positions in healthcare companies

Find out more

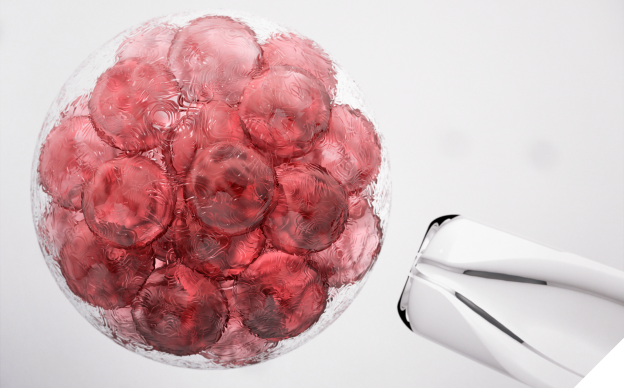

Our focus

We are a venture capital firm focused on the life science and medical device sectors. We invest through direct secondary transactions to provide flexible liquidity solutions to investors or corporations.

Our people

We are headquartered in the UK and our team is located across Europe and Asia, providing us with broad geographic networks that have proven useful to support our portfolio companies.